Posts

By doing so, you might be from the greatest reputation to help you file an accurate income tax go back. Whenever filing a tax return it is very important to guarantee the proper, extremely right up-to-day contact info, such target and you will contact number, is actually listed on your own come back. Having your family savings suggestions upwards-to-time is extremely important to stop any undesired complications with their lead deposit. Don’t let wrong information slow down your reimburse – make sure to make sure this information ahead of entry your own return. Qualified Ca residents automatically gotten the Wonderful County Stimuli money thanks to head deposit or report monitors, which isn’t you’ll be able to to trace them on the net. Repayments were given utilizing the refund alternative you chose on your own income tax get back.

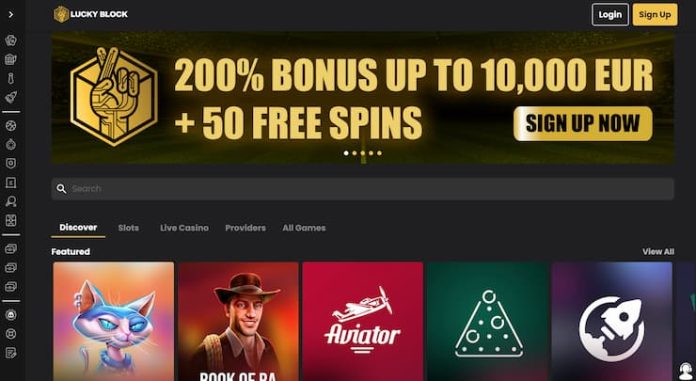

Low Minimal Put Online casinos

Lost assets, for example an engagement ring happen to decrease on the street, is an activity which is inadvertently, inadvertently discontinued. And you can mislaid property is purposefully set somewhere—for example money on a lender avoid you casino Betsson review to definitely a customer intentions to deposit—but then lost. Mislaid possessions, Orth says, is meant to end up being protected by the anybody who is the owner of the home in which it had been mislaid up until anyone that have a much better allege, including the lender customers, comes back. Quit assets and you will destroyed property will end up being dealt with from the effortless “finder-keepers” edict. Gambling enterprises render no-deposit incentives as the an advertising equipment to attract the brand new players, going for a taste away from just what casino offers assured they’ll continue to enjoy even with the advantage is actually put. The gambling enterprises noted on these pages offer certain no-deposit incentives both for the newest and you will established people.

Depository Credit Intermediation

Our Faqs page will bring information on put insurance rates, FDIC steps in the eventuality of a bank failure, searching for a covered financial, and a lot more. The newest finances prices $586.9 million was available to qualify out of Part 56, Legislation of 2022 (Abdominal 195). It laws mandates allocating fund in order to “Allocation step 3 Apps,” targeting youthfulness education, ecological shelter, and personal defense. The brand new estimated finances comes with $341.3 million to have youth compound play with infection applications, $113.8 million to have handling environment influences of illegal cannabis cultivation, and something $113.8 million to have public shelter-related things. Taxpayers receive both $350, $250 or $200 according to the earnings height, having an extra percentage of the same matter whether they have one dependent. You should use that it on the web equipment in order to guess the amount of money you should discover.

Perform Video game account provides charge?

Such taxation which can be shown on the Function 100W, Plan An excellent, must be put into income by the entering the number to your Top step 1, range dos otherwise range step three. Discover Plan A good, line (d) to your amount to be added to income. To find net income to own California objectives, organizations by using the federal reconciliation means must go into Ca alterations so you can the brand new government net gain on the web dos because of line 16.

Check in A free account To begin with

Set up a primary deposit to your a top-yield bank account to ensure that a portion of one’s money try instantly saved. The quantity you set aside depends upon your income, costs, loans and private comfort and ease. Funding You to definitely 360 Efficiency Offers is a wonderful alternatives for those who’lso are looking for a premier-yield family savings it is able to bank myself if you are avoiding very costs and you will minimal requirements. It’s a predetermined interest rate which can be FDIC-insured, 1 definition your money is actually safe to applicable restrictions.

Digital Government Credit Connection Typical Permits

Although not, armed forces spend isn’t California supply earnings whenever a good servicemember is actually forever stationed outside Ca. Beginning 2009, the brand new government Army Spouses Residence Recovery Operate can impact the newest Ca taxation filing standards to own spouses out of army group. Catch-Upwards Efforts definitely Someone – To own taxable years beginning for the or once January step 1, 2024, the new federal CAA, 2023, offers the newest indexing to your $step one,000 catch-up contribution in order to a keen IRA for those decades 50 or elderly. The newest CAA, 2023, along with expands particular share quantity, in addition to connect-up benefits for individuals years 50 or over because the defined inside the IRC Part 414(v).

Technical Account

If your get back will be registered for a short period (lower than one year), generate “brief year” inside black colored otherwise bluish ink regarding the finest margin. To possess purchases which need withholding, a seller of Ca a home can get choose an alternative choice to withholding step 3 step one/step three % of your overall transformation rates. Owner get choose an option withholding matter according to the limit income tax speed for those, businesses, or financial institutions and you will economic businesses, as the applied to the brand new get for the sales. The vendor is required to approve under penalty out of perjury the brand new option withholding amount to the newest FTB. When the an enthusiastic LLC elects to be taxed since the a partnership for government income tax aim, it should document Setting 568. LLCs taxed while the partnerships determine the money, deductions, and credits within the Private Income tax Laws and so are subject so you can an annual tax as well as a yearly fee based to your full income.